ASM Int. Stock: Keeping Moore’s Law Alive, Profiting From It (OTCQX:ASMIY)

Table of Contents

Toggle [ad_1]

Laurence Dutton/E+ via Getty Images

ASM International (OTCQX:ASMIY) is a semiconductor equipment manufacturer that specializes in atomic layer deposition, or ALD, and Epitaxy tools and machines. These devices are incredibly complex, requiring a lot of expertise and years of R&D to bring to market.

In other words, ASM offers a number of methods and accompanying machines to deposit thin films of materials, something which is becoming critical to manufacture advanced chips. As pushing forward Moore’s Law gets more complicated, these machines are increasingly important, placing companies like ASM in a privileged competitive position.

Products

Before getting into the financials, let’s understand a little bit better the products that ASM offers. ASM designs and sells both single-wafer deposition tools, in which the process is performed one wafer at a time, as well as so-called batch tools, in which the deposition is performed on multiple wafers at a time. The prices of the company’s systems vary, but typically are several million euros per system.

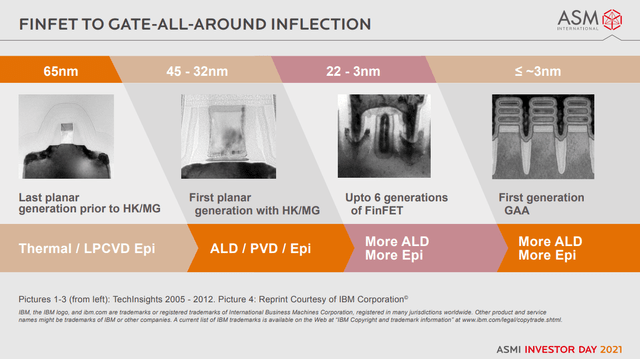

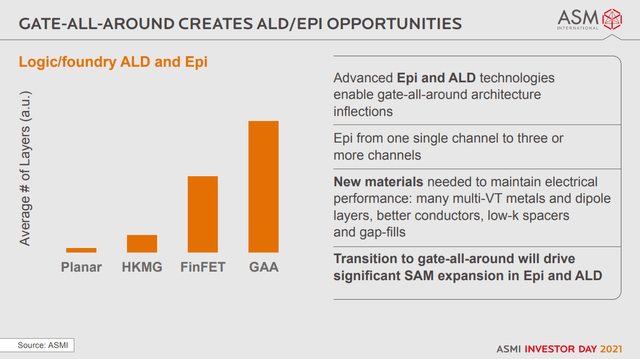

ASM is the leader in ALD and expanding in Epi, technologies that are expected to outgrow the WFE market driven by key inflections such as gate-all-around technology. The products can be categorized by type of deposition method:

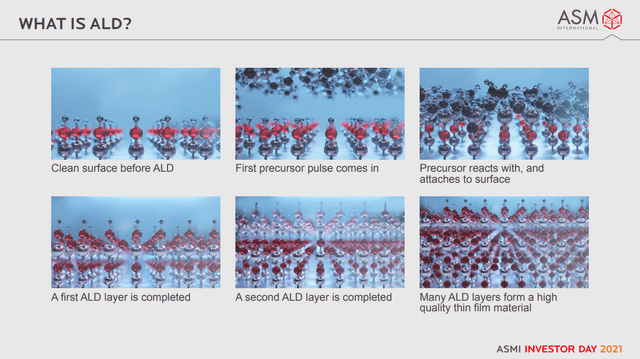

Atomic Layer Deposition is a layer-by-layer process that results in the deposition of thin films one atomic layer at a time in a highly controlled manner. Layers are formed during reaction cycles by alternately pulsing precursors and reactants and purging with inert gas in between each pulse. It offers unmatched capability to conformally cover 3D structures with complex materials, with near perfect composition and electrical properties control.

AMS Investor Presentation

Epitaxy, or Epi for short, is a process that is used for depositing precisely controlled crystalline silicon-based layers that are important for semiconductor device electrical properties. The silicon epitaxy process can be used to modify the electrical characteristics of the wafer surface to create high-performance transistors during the manufacturing of semiconductor chips.

Chemical Vapor Deposition is a chemical deposition process in which the wafer is exposed to one or more volatile precursors, which react and/or decompose on the substrate surface to produce the desired film. Within Chemical Vapor Deposition (CVD) ASM offers two types of tools: single-wafer plasma enhanced CVD (PECVD) and batch low pressure CVD (LPCVD).

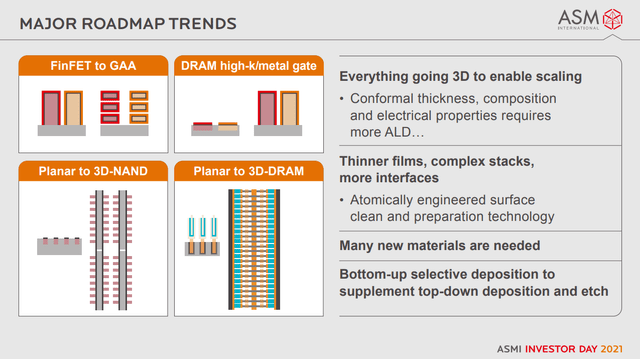

Competitive Advantages

As the market share leader in ALD tools, ASM International has thousands of patents, trade-secrets, and know-how that give its business a wide competitive moat. ALD equipment was usually employed only when absolutely required because of the high cost, but they are now being used considerably more as a result of technical challenges to continue Moore’s Law, and which are requiring novel 3D architectures where ALD is necessary. These 3D transitions and materials lead to opportunities for ASM in the ALD and Epi markets, given the requirements for layers that are highly uniform and with specific electrical properties that require deposition of new materials.

AMS Investor Presentation

Another source of ASM’s competitive advantage is its close collaboration with its most important customers. This is critical, as feedback and shared knowledge is fundamental to be able to manufacture these increasingly complex semiconductor nodes and overcome the technical and physical challenges. These close collaborations and years of working together mean that its customers would be a lot more hesitant to replace them with another manufacturer, meaning there is an important switching cost to replace them.

AMS Investor Presentation

Financials

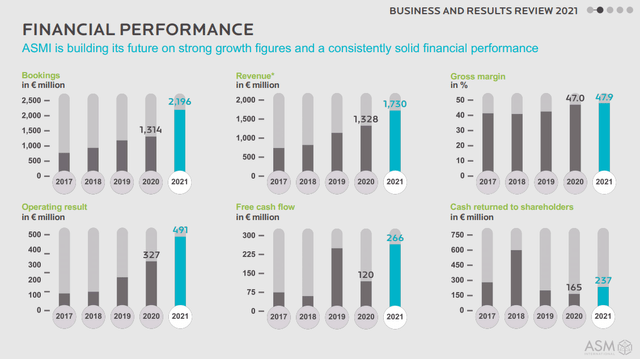

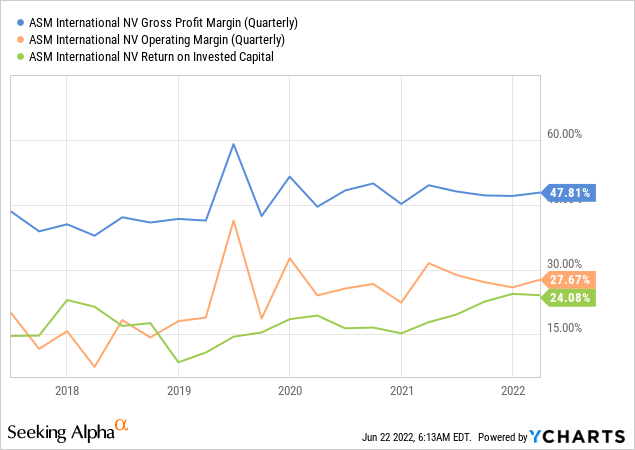

The growing importance to the semiconductor industry of the type of equipment ASM manufactures has translated into increasingly attractive financials.

AMS Investor Presentation

Its revenue has been growing quickly the last five years, and this has been profitable growth with operating margins that are approaching 30%. The company’s ROIC has also improved considerably, and is now around 24%, which is superb for a manufacturing business.

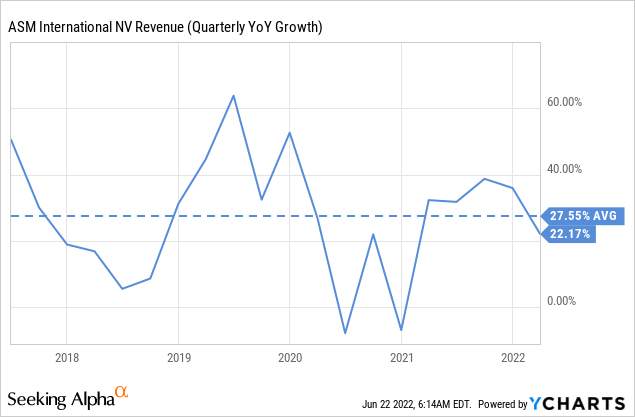

Over the last five years revenue growth has averaged ~22%, and according to management rapid growth is expected for the next few years since the expectation is that the company will grow revenue to €2.8-€3.4 billion by 2025 representing a CAGR of 16-21%, with an operating margin of 26-31%.

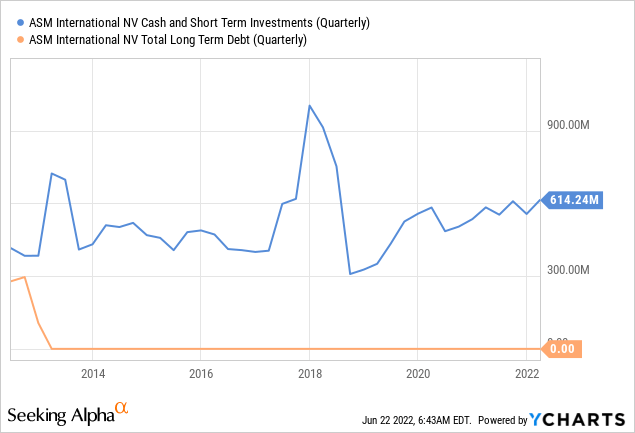

The company has a solid balance sheet with hundreds of millions of dollars, and basically no long-term debt.

ESG

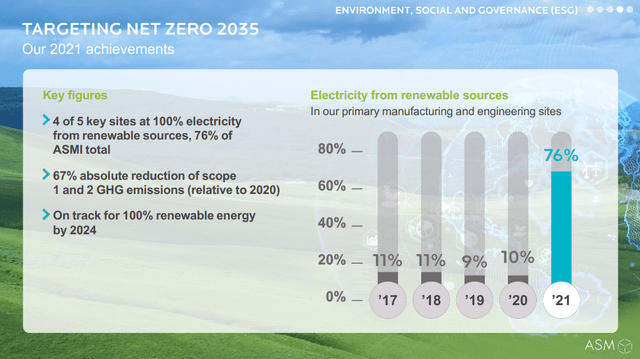

ASM International is increasingly taking ESG seriously, and now has 4 of its 5 key manufacturing sites operating 100% from renewable sources of electricity. Thanks to efforts like this the company is set to be included as one of 25 companies in the new AEX® ESG Index for companies that demonstrate the best ESG practices.

AMS Investor Presentation

Growth

The single-wafer ALD market is expected to grow from ~US$1.5 billion in 2020 to approximately US$3.1-US$3.7 billion in 2025, outgrowing the WFE market. The Epi market is expected to grow from ~US$0.8 billion in 2020 to approximately ~US$1.5-US$1.8 billion in 2025, outgrowing the WFE market as well. The company’s strategic objectives are maintaining leadership in logic/foundry, achieve expansion in memory, obtain share gains in the Epi market, and grow the spares and services segment.

Fortunately for the company the most advanced nodes (7nm and below) are structurally the fastest growing parts of the WFE market, which are ASM’s strength.

AMS Investor Presentation

In general, the current R&D portfolio is well aligned with customer roadmaps to further extend Moore’s Law. An example of this is the FinFET to Gate-All-Around transition, which will require much more ALD and Epi.

AMS Investor Presentation

Valuation

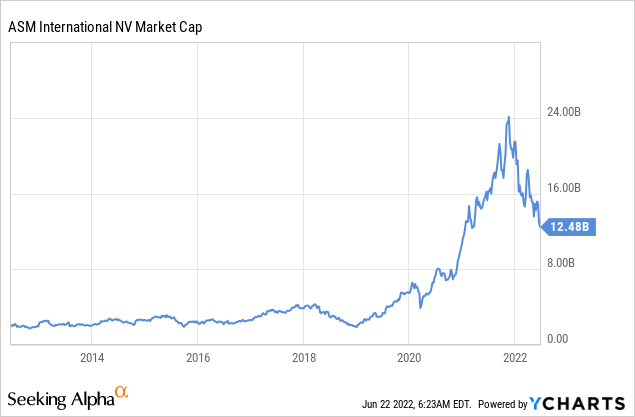

With the increased revenues and profits the company is now valued at a much higher market cap, even after accounting for the recent sell-off. At present the market cap of the company is about $12.5 billion. It can be argued this is not too high for a company that is one of the few in the world that hold the keys to further advancing Moore’s Law, which has proven so critical in the semiconductor industry.

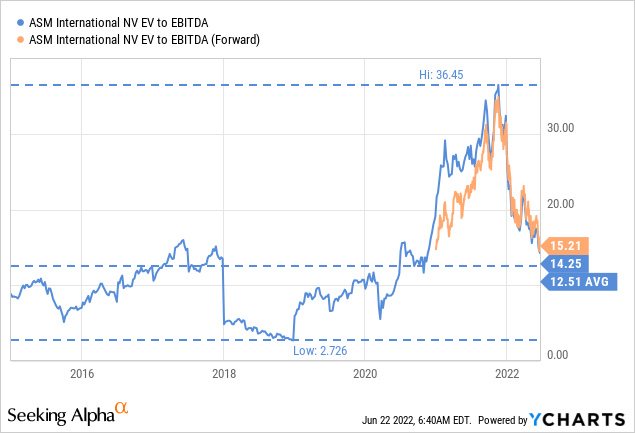

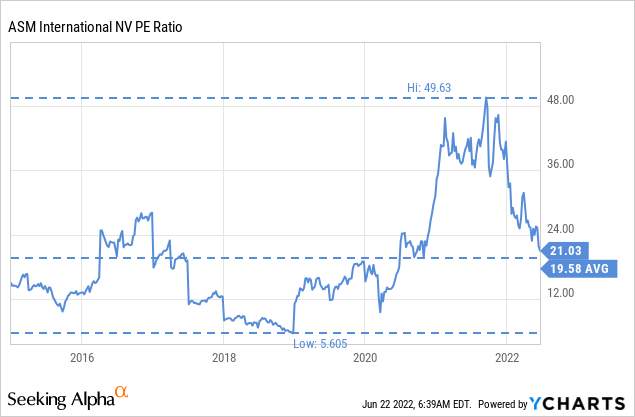

After the recent stock price correction, the company is again trading close to its ten-year average EV/EBITDA.

The current price/earnings ratio is not too demanding at ~21x, and it is also close to its ten-year average.

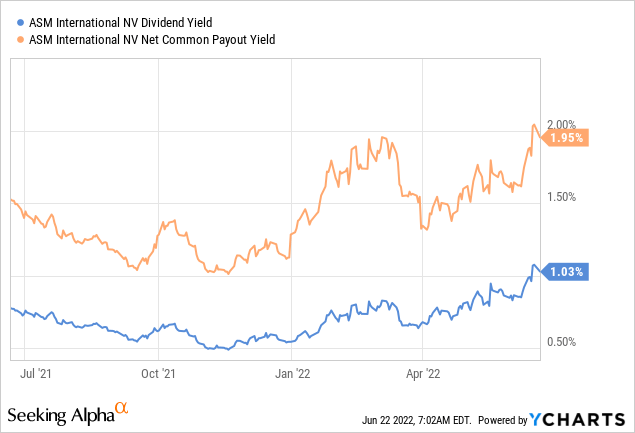

The company pays a dividend, which has been growing quickly, but the yield is not too high. Dividends gradually increased from €0.40 per ordinary share in FY10 to €2.00 in FY20. The current dividend yield is ~1%, and the net common payout yield, which includes net share repurchases, is closer to 2%.

To Buy or Not to Buy

Given that management is guiding for growth of 16-21% from now to 2025, and with a P/E ratio just a little over 20x, we believe this is a solid buy at current prices, given a PEG ratio of close to 1.0. In the current macro-economic climate, we would not be surprised to see the shares get cheaper, but the valuation is reasonable enough to justify a starter position, at least in our opinion.

Risks

While ASM is the market share leader in ALD and has a solid position in Epi, the growth in importance of these technologies could attract other semiconductor equipment manufacturers to try an enter the market. Some of the potential competitors have more resources than ASM, such as Lam Research (LRCX) and Applied Materials (AMAT). It is therefore to be expected that its leadership position will be challenged by aggressive competition.

Conclusion

ASM is the leader in some of the key technologies necessary to keep Moore’s Law alive over the next 5-10 years. This should result in above market growth for the company, and rapidly increasing revenues and profit. The valuation appears reasonable given the strong position the company has, but it is likely that its success will attract competition. We view shares as a ‘Buy’, but would not be surprised if they become cheaper as a result of the current macro-economic environment.

[ad_2]

Source link