[ad_1]

InvestorPlace – Stock Market News, Stock Guidance & Trading Guidelines

Stocks crashed yesterday soon after the U.S. federal government released its May well careers report.

Supply: TierneyMJ / Shutterstock

Oddly, the report was quite sturdy. The U.S. economic climate included more work opportunities in May than any one envisioned. And continue to, stocks crashed, typically mainly because we’re in a “good news is lousy news” environment on Wall Road.

Much more on that afterwards.

But for now, allow me convey to you this. I consider Wall Avenue wholly misinterpreted yesterday’s work opportunities report. And as an alternative of it being a purpose to provide stocks, it supplied considerable ammunition to the bull thesis.

For that reason, yesterday’s selloff in shares probably won’t previous. We see a large reversal on the horizon. And we believe the rebound that shares have been staging since early May well is the starting of some thing considerably bigger…

Here’s why.

Great Information Is Terrible Information

Yesterday, we got news that the U.S. labor market place is on hearth, developing many much more positions in May than predicted. You’d assume that would guide to a major marketplace rally, in particular due to the fact everyone’s speaking about a probable “recession” these times.

But it did not.

Alternatively, stocks crashed soon after the Might work report was introduced.

Why? For the reason that we’re in the “superior information is negative news” stage of the market cycle.

That is, stocks’ largest enemy suitable now is the Fed. It is charted a course for numerous rate hikes in 2022. The additional the Fed hikes costs, the extra possible the U.S. financial system is to spill into a economic downturn. And the farther shares will tumble. The converse is correct, also.

Thus, when it will come to stocks correct now, it’s all about the Fed and price hikes. Nearly anything that improves the odds of larger prices is bearish. Something that decreases the odds is bullish.

A warm overall economy improves the odds of more greater fees.

Yesterday’s red-very hot work opportunities report underscores that the U.S. financial system is nonetheless fairly scorching. And as a result, it increased the odds of more price hikes from the Fed.

So, stocks crashed in response.

But we assume that yesterday’s powerful jobs report was the previous hurrah of a labor market on the brink of collapse.

That may well sound like terrible information. But it is really genuinely bullish for stocks.

Who’s Using the services of These Days?

Anyone was so blown away by the large defeat in the headline work report that they missed the larger-picture development. Position creation in the U.S. is promptly slowing, and points are only heading to get even worse at an accelerated rate.

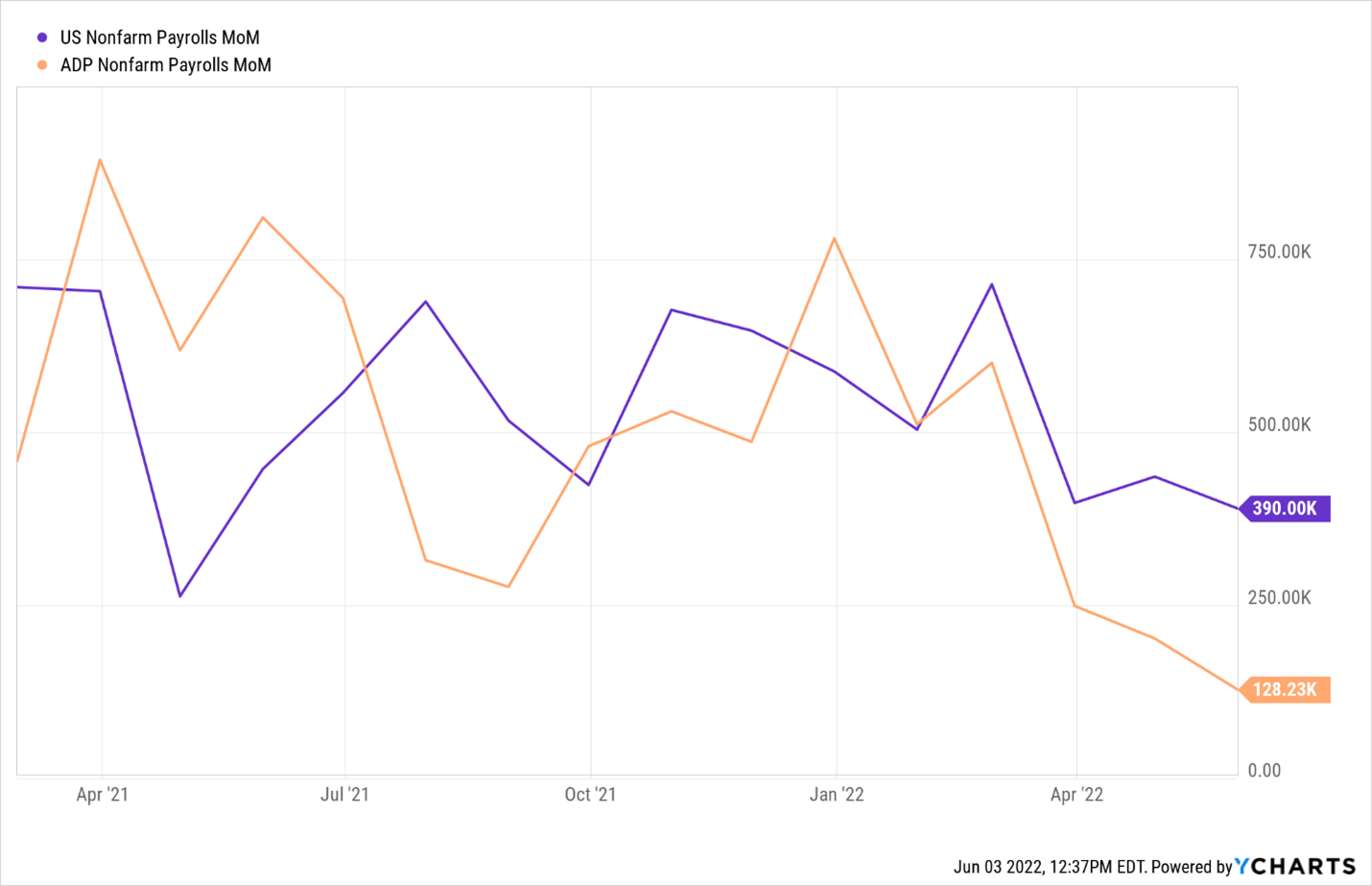

Prior to May perhaps, the U.S. overall economy designed extra than 400,000 employment per month for a file 10 straight months. Throughout the finish of 2021 into the to start with handful of months of 2022, the economy was adding north of 500,000 jobs per month.

In that context, May’s 390,000 new positions selection is rather weak. And when coupled with a identical looking at from the ADP employment report, it displays a labor marketplace which is materially slowing.

This slowdown is going to get worse — a lot even worse — and incredibly rapidly.

Positions Cooldown

Just yesterday, Elon Musk reportedly despatched an email to staff expressing Tesla (Nasdaq:TSLA) will hearth 10% of its workforce. The pretty very same working day, Coinbase (Nasdaq:COIN) introduced that it would pause its present-day hiring freeze for the foreseeable future.

These are not isolated illustrations.

Across the tech marketplace, firms are either slowing or pausing their selecting, or outright firing people today entirely.

Netflix (Nasdaq:NFLX), Robinhood (Nasdaq:HOOD), Carvana (NYSE:CVNA), Klarna and PayPal (Nasdaq:PYPL) all declared planned layoffs about the past few months.

Microsoft (Nasdaq:MSFT), Nvidia (Nasdaq:NVDA), Lyft (Nasdaq:LYFT), Snap (NYSE:SNAP), Uber (NYSE:UBER), Salesforce (NYSE:CRM), Meta (Nasdaq:FB) and Twitter (NYSE:TWTR) have all possibly slowed or paused selecting more than the past several months.

That has significant ramifications for the labor sector. Some companies that I just stated have been some of the economy’s most important job creators more than the earlier couple of a long time. Turn those people work creators into position destroyers, and which is how you get a collapse in the labor marketplace.

We wouldn’t be astonished to see headline payroll quantities drop down below 100,000 by July and possibly transform adverse by August or September.

Given that these types of a collapse would bring about the Fed to pause rate hikes, which is amazingly bullish for shares.

Wage Expansion Is Dropping

A totally overlooked good details level from yesterday’s work opportunities report was the continued drop in wage advancement.

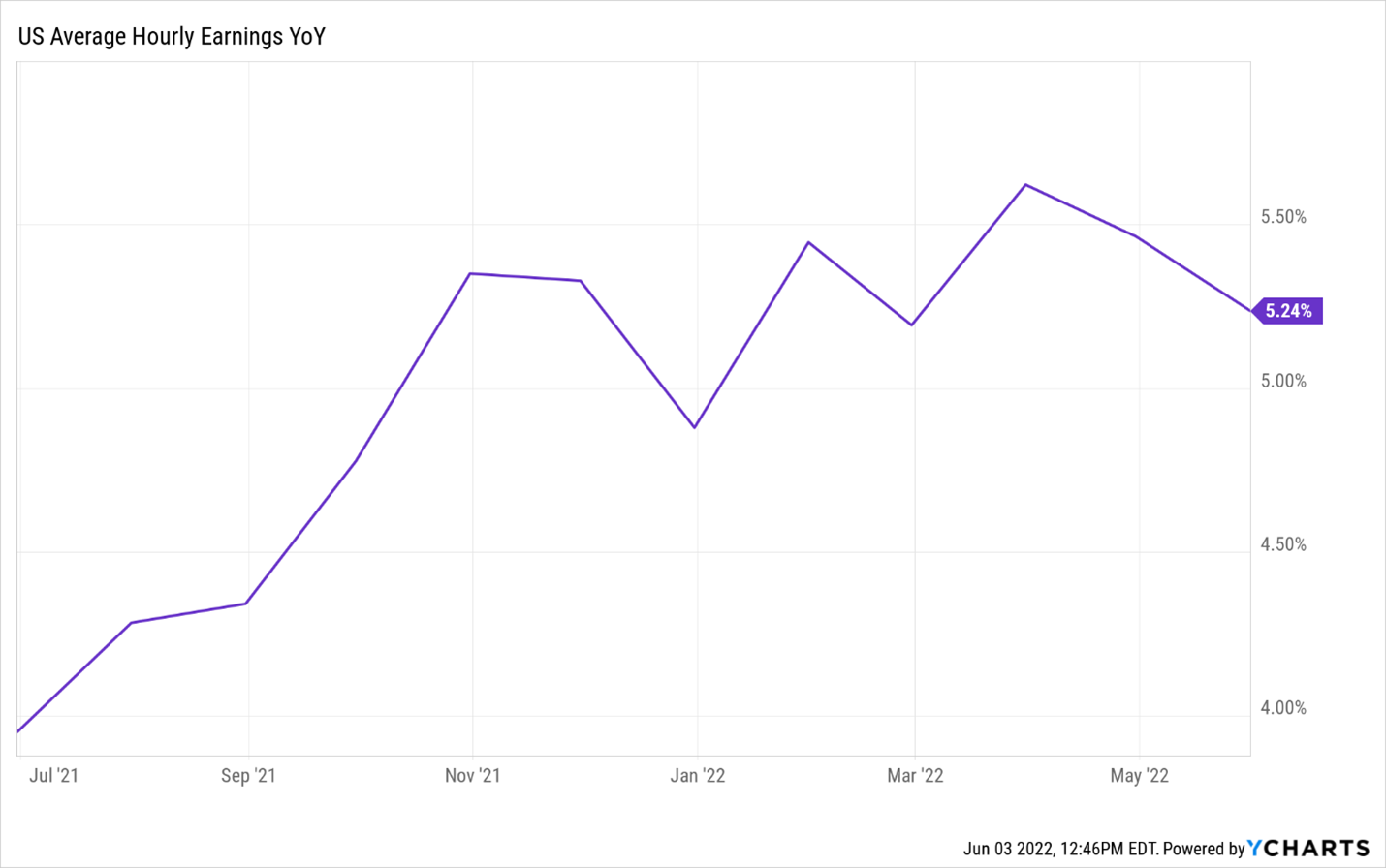

May wage progress missed expectations, and regular hourly earnings expansion was just 5.2%. That represents the next consecutive thirty day period of slowing wage development — a first given that early 2021.

That is actually bullish on the inflation entrance mainly because wage expansion is 1 of its stickiest motorists.

If wage progress carries on to neat, inflation — which is by now easing — will preserve falling, as well. If inflation retains decelerating, the odds of large charge hikes in the back half of 2022 will drop. And if that occurs, the financial state will stabilize. And stocks will rebound.

We’re fairly self-confident in expressing that wage expansion will hold dropping.

The organizations that are pausing hiring today are some of the economy’s best payers, also. The common foundation wage more than at Tesla is north of $100,000. At Facebook, it is around $125,000. At Netflix, it is $135,000. And at Nvidia, it’s $144,000.

In other words, the economy’s best-spending businesses are either slowing employing, pausing selecting, or outright firing folks. By natural means, that implies wage development need to keep on to tumble.

And once again, that signifies inflation should decelerate, and stocks ought to rally.

The Last Phrase on the Work Report

Wall Road entirely misinterpreted Friday’s careers report. It was bullish for stocks — not bearish.

The actuality is that the U.S. financial state is in a really excellent “Goldilocks” condition right now. It’s not hot enough to warrant even more intense Fed action. And it is not awesome adequate to say we’re sure for a deep economic downturn.

It’s the best temperature.

Here’s what will materialize around the subsequent several months.

The economic system will sluggish in June and July as the Fed hikes prices a different 50 basis points at each conference. By August, the labor marketplace will be considerably weaker than it is nowadays, and inflation will be considerably decreased. The Fed will reassess its monetary policy. And occur September, it’ll both pause or pivot to a lot more dovish 25-foundation-issue hikes. At that place, the U.S. economic climate will get back misplaced momentum and expand healthily into 2023.

Shares will rebound — strongly.

But bear in mind the stock sector is ahead-seeking. It will bounce in advance of the Fed pivots dovish and the economic system regains momentum. Is that bounce previously happening? Is that why stocks have rallied more than the earlier month?

That’s really achievable. And as these, we believe the most effective shift nowadays is to situation yourself for a big “U-turn” in the markets.

Which is what we’re carrying out in our flagship investment decision research merchandise Innovation Trader. And so considerably, it’s having to pay off. Our Top rated 10 stocks model portfolio has crushed the market place by much more than 6X over the earlier thirty day period!

So, if you are sensation like the marketplaces are all set to phase a huge comeback, I really recommend you plug into a portfolio all set to roar in the again 50 % of 2022.

On the date of publication, Luke Lango did not have (both immediately or indirectly) any positions in the securities stated in this article.

The write-up Today’s Strong Jobs Market Could Soon Collapse appeared 1st on InvestorPlace.

[ad_2]

Source connection